15 Year Mortgage VS 30 Year and Invest

Home ownership is one of the largest financial decisions you will make and there's a lot to look forward to. We get to save up that equity, minimize rent expense and get a little value increase through appreciation. However, what is the best mortgage duration to choose, 15 year or 30 year? Let's take a look at 2 principles and see which one improves your financial future the most. 15 year pay off vs 30 year but invest the difference goal.

15 Year Debt Free Principle

Being debt free and achieving financial freedom is an amazing accomplishment. Paying off your house in 15 years would lower the total interest paid by a whopping 62%. If I see shirt on sale for 50% off, I get excited. 62% is a big deal.

While some recommend paying off your house fast and being debt free, there are some things to consider with that. A home is not a liquid asset and if you need money, selling or refinancing is difficult and this could be a loss. It can take a long time to sell a house and has a steep fee to sell it at 6%. Even after paying it off, a home will always have costs such as maintenance, taxes, insurance and hoa fees.

If you focus on paying off your house aggressively you will be debt free, but you will have an illiquid asset you are sitting on. I call this House Rich, Cash Poor. What is the trade off or opportunity cost?

30 Year Mortgage and Invest, A High Cash Flow Principle

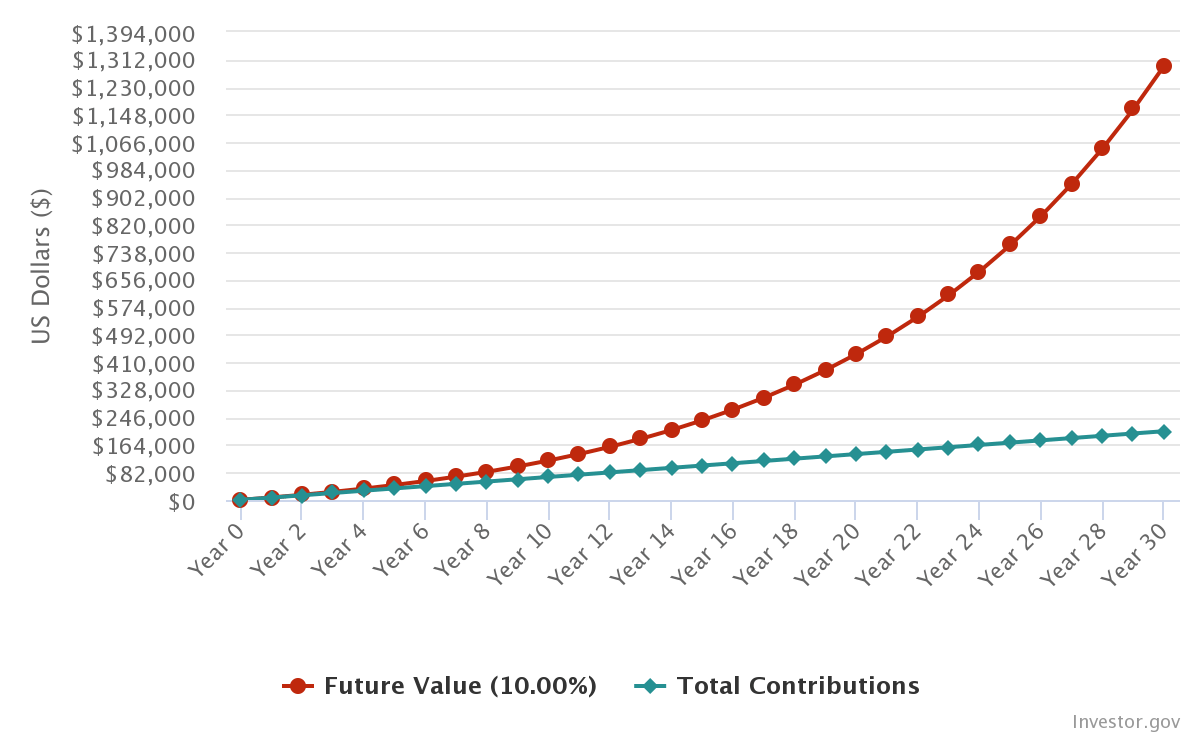

The monthly mortgage cost difference between a 15 year and 30 year mortgage can be $568 for a $300,000 home. I've decided to invest that extra money instead of putting it towards my house. A $568 per month investment with 10%(1) interest gain can amount to $1.3 million(2) in 30 years! This is far more than the interest you would have paid to the lender over those 30 years.

Even a home that is fully paid off will still have costs. A $300,000 home you own outright can still cost you $850(3) per month in maintenance, insurance, property taxes and hoa fees indefinitely.

A stock and investment portfolio is liquid, you can live off the interest, sell shares or re-invest. If you focus on building assets that bring in cash flow such as investments and vacation homes, these will consistently generate increasing cash flow for the future so you are no longer cash flow poor.

15 Year vs 30 Year Home Loan Example

15 Year Breakdown at 3% Interest

Monthly Payment $1,646

Down Payment $60,000

Total Principal $240,000

Total Interest $56,258

30 Year Breakdown at 3.5% Interest

Monthly Payment $1,078

Down Payment $60,000

Total Principal $240,000

Total Interest $147,976

Investing Chart Example

Investing $568 each month for 30 years at 10% interest gain will result in $1,300,000. At year 30 this portfolio will have $130,000 per year in interest gain which is a nice raise! Either strategy you choose, you should at a minimum always invest into a stock portfolio and/or other cash flow generating principles.

How To Get Started? Here are my favorite investing Apps.

Start off by trying out these popular 3 to compare and learn more about these tools. I can't tell you which stocks or ETFs (Exchange Traded Funds) to buy but some great starters are VYM, VOO and VTI. The key is starting.

- Sign up for free @ Webull and we both get free stocks.

- Sign up for free @ RobinHood and with both get a free stock.

- Sign up @ M-1 Finance get $30 intro sign up bonus.

Note: I am not a financial advisor. Here I'm sharing my financial freedom journey. There's certainly risk involved in investing, so do your research or consult with an financial advisor.

References

1. Average annualized return for 30 years from 1990 - 2020 was 10.7%.

2. Investor.gov Interest Calculator is a great tool to calculate interest earning goals.

3. Estimated home cost per month of $850 includes; Maintenance $250, Insurance $192, Taxes $267 (national average), HOA of $140.